Cambridge University Press

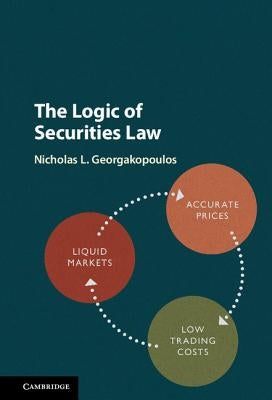

The Logic of Securities Law

The Logic of Securities Law

Couldn't load pickup availability

Author: Nicholas L. Georgakopoulos

Publisher: Cambridge University Press

Published: 05/04/2017

Pages: 225

Binding Type: Hardcover

Weight: 1.01lbs

Size: 9.00h x 6.00w x 0.56d

ISBN: 9781107158504

About the Author

Georgakopoulos, Nicholas L.: - Nicholas Georgakopoulos is the H. R. Woodard Professor of Law at the Robert H. McKinney School of Law, Indiana University. He has extensively researched and published on Securities Law and related fields. His previous publications include Principles and Methods of Law and Economics (Cambridge, 2005), and a co-authored five-volume treatise Blumberg on Corporate Groups.Georgakopoulos, Nicholas L.: - Nicholas L. Georgakopoulos is the H. R. Woodard Professor of Law at the Robert H. McKinney School of Law, Indiana University. He has extensively researched and published on securities law and related fields. His previous publications include Principles and Methods of Law and Economics (Cambridge, 2005), and a co-authored five-volume treatise Blumberg on Corporate Groups.